Modern financial management systems (FMS) stand as a testament to the transformation of the digital landscape. The role of FMS has expanded and evolved, becoming a linchpin that underpins not just finance, but the entire operational framework of a business.

The harbinger of this revolution? Liberating financial data.

In the past, a traditional FMS was seen as the gatekeeper of all financial data, handling everything from invoicing to customer and supplier contact details and pricing. It was a walled garden, accessible only by the finance team, who had complete control over pricing and billing.

However, with the capabilities that integration and automation unlock, this model is fast approaching obsolescence. Instead of hoarding data in isolated silos, modern systems are growing and feeding a business culture of visibility and transparency.

OnAccount, for instance, champions this philosophy of visibility.

Integrated financial management in action

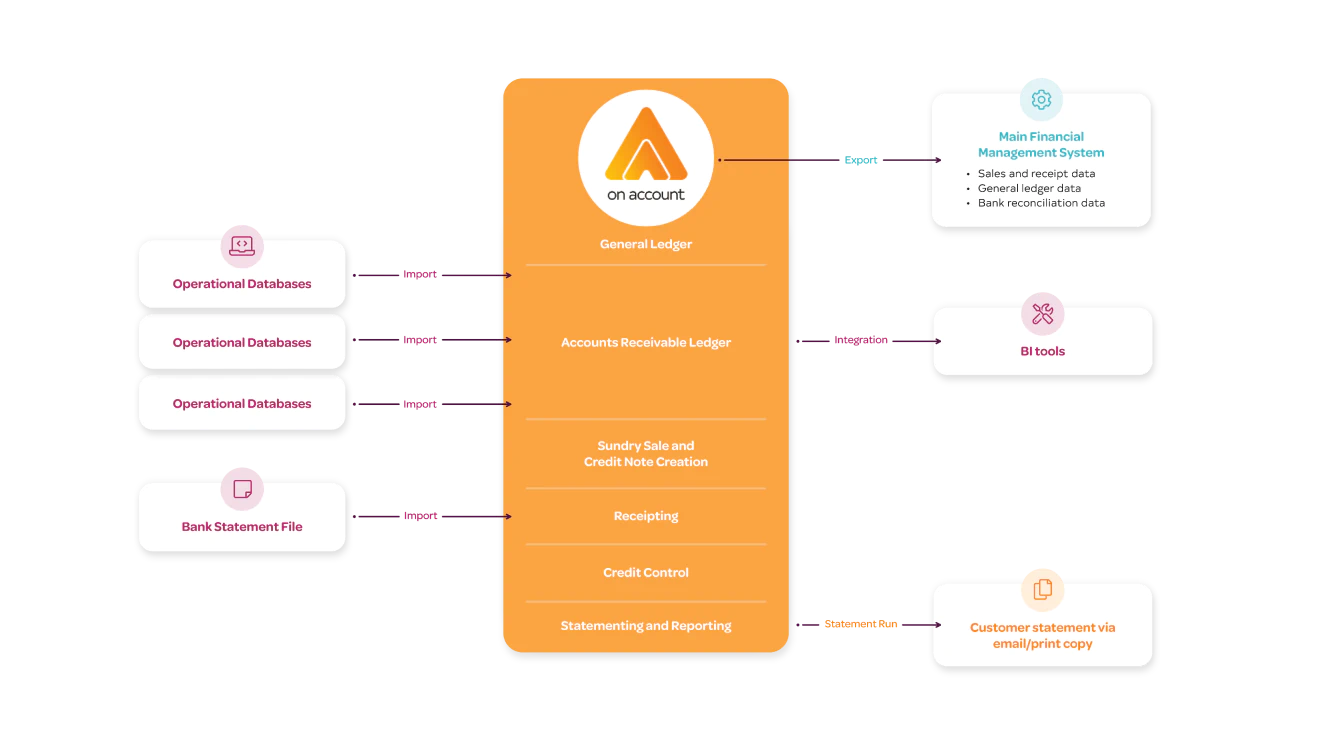

Our unique architecture negates the need to log in and out of multiple systems, without compromising your system use or double-handling data.

For example, you can produce an invoice in the source sales system, deliver it to the customer and then pass the invoice information to OnAccount for receipting payments, reconciling debtors accounts and reporting financial results.

High volume transactions can be consolidated to just a few lines, with detail accessible via a hyperlink to the sales system where pricing is managed by sales managers. Data lives where it belongs, but without the usual lack of visibility across systems.

It’s an ecosystem of data with fewer touchpoints and redundancies — and therefore greater efficiencies.

Many of our customers adopt a master data or invoice at source architecture with integration to OnAccount. With two-way integration, receipting and sundry invoicing created in OnAccount can also be sent to the operational system. This way data isn’t duplicated, yet teams accessing both systems have the most up to date account information at their fingertips.

It’s a two-way source of truth.

And with deep automation capabilities built in, you can shift your focus from manual tasks to high-value strategic business initiatives.

It’s from this philosophy that OnAccount evolved.

We consolidate invoicing from different source databases into a single customer statement. With your customer relationships as a priority, no longer do you need to have customers receiving different statements when involving different divisions. Often they just want to make one payment against one supplier account. And now they can.

With operational and financial data centralised, OnAccount delivers on transparency across your business and processes.

Discover the power of data transparency. Reach out today to see how OnAccount de-silos your financial and operational data.